A decision in the Purdue Pharma1 bankruptcy reinforces a cornerstone of bankruptcy jurisprudence: the longstanding authority of bankruptcy courts to grant derivative standing to official committees of unsecured creditors.

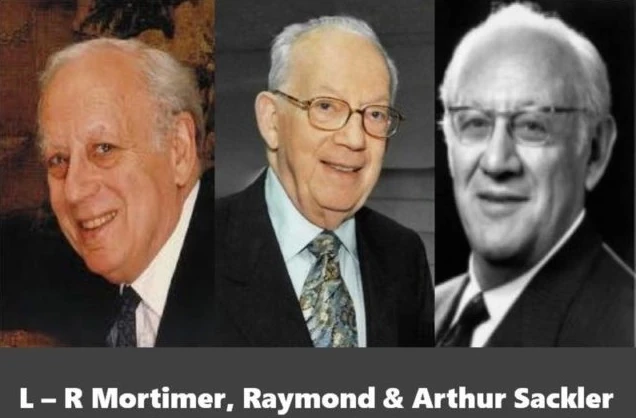

Faced with a motion from the Purdue unsecured creditors’ committee requesting to commence and prosecute estate claims against the Sackler family, New York Bankruptcy Judge Sean Lane held firm to decades of precedent recognizing committees’ standing to bring such derivative actions when the debtor consents and the litigation benefits the estate. The court emphasized that this authority is implied from the Bankruptcy Code itself, specifically Sections 1103(c)(5) and 1109(b), and has been recognized by the Second Circuit since 1985 in the STN Enterprises2 bankruptcy case. The Fifth Circuit similarly has authorized derivative standing to creditor committee since 1987 in the Louisiana World Exposition3 bankruptcy case.

Parties opposing the committee’s request for standing argued that Delaware state law governing limited partnerships barred the committee from bringing derivative claims against the Sacklers. However, Judge Lane, aligning with recent decisions on this issue such as Pack Liquidating4 (Delaware) and The McClatchy Company5 (New York), made clear that state law does not limit a bankruptcy court’s power to grant creditor committees derivative standing to pursue claims on behalf of the bankruptcy estate. The court held that where the debtor consents and the claims are colorable and, in the estate’s best interest, the court has broad equitable authority to confer standing.

The Purdue Pharma opinion is a fresh reminder: in bankruptcy, federal law—not state law —controls the rules of the game when it comes to pursuit of claims belonging to the bankruptcy estate.

1 In re Purdue Pharma L.P., No. 19-23649 (SHL), 2024 WL 4820476 (Bankr. S.D.N.Y. Nov. 18, 2024).

2 Unsecured Creditors Committee of STN Enterprises, Inc. v. Noyes (In re STN Entreprises), 779 F.2d 901 (2d Cir. 1985).

3 In re Louisiana World Exposition, Inc., 832 F.2d 1391 (5th Cir. 1987).

4 In re Pack Liquidating, LLC, 658 B.R. 305 (Bankr. D. Del. 2024).

5 In re The McClatchy Company, Case No. 20-10418 (MEW) (Bankr. S.D.N.Y. 2020).

Case Citation: In re Purdue Pharma L.P., No. 19-23649 (SHL), 2024 WL 4820476 (Bankr. S.D.N.Y. Nov. 18, 2024).

The content of this blog post is for informational purposes only and does not constitute legal advice. It provides a summary, and the referenced materials should be reviewed for full details. The information may not reflect current legal developments. The date of the publication of the post is applied at the discretion of the editor and no reliance should be made on the date of publication. Please reach out to Parkins & Rubio LLP or your attorney for guidance.

Topics Discussed: Bankruptcy Jurisprudence, Derivative Actions, Derivative Claims, Derivative Standing, Purdue Pharma, Purdue Pharma Opinion