Six Things to Consider

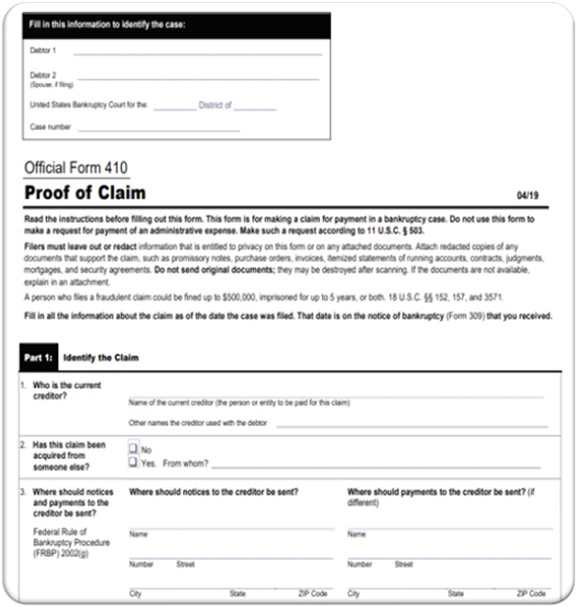

A claim holder asserts a claim against a debtor in bankruptcy by filing a proof of claim (an equity holder asserts a proof of interest). In most bankruptcy cases, a “bar date” is set that establishes the deadline by which creditors must file their proofs of claim. This “bar date” is a strict deadline so creditors regularly hurry to file the Official Form 410 Proof of Claim before the deadline. Most of the time, this is a straight-forward exercise.

While straight-forward, the mere filing of a proof of claim can have adverse consequences on the claimant. By filing a proof of claim, a claimant subjects itself to the jurisdiction of the bankruptcy court and waives its Seventh Amendment right to a jury trial to determine the amount and legitimacy of the claim.

Once the creditor subjects itself to the jurisdiction of the bankruptcy court, the bankruptcy court may engage in the process of “allowance and disallowance of claims,” including resolving the counterclaims that might be filed against the creditor. The bankruptcy judge – and not a jury – will decide the amount of the counterclaims against the creditor. Such counterclaims could dwarf the amount of the claim leading to the potential for the claimant to owe the debtor money.

Therefore, a creditor should carefully consider whether it should file a proof of claim.

Determining whether to file a proof of claim should be done on a case-by-case basis. Here are six things to consider:

- Whether the Claim Is Scheduled. Under Bankruptcy Rule 3001(b)(1) for creditors and equity security holders in chapter 9 and 11 cases, if the a creditor or equity security holder whose claim or interest is not scheduled as either disputed, contingent, or unliquidated then the claim or interest is deemed to be a valid without the need to file a proof of claim or interest.

- Amount of the Claim. If the claim is small or if recovery is unlikely, these would be reasons to not file a claim. Oftentimes under a confirmed plan of reorganization, unsecured creditors will receive pennies on the dollar. The creditor must balance the recovery with the time and expenses, including legal fees, incurred in connection with preparing and filing a claim and dealing with any objection or counterclaim to the proof of claim that may be filed in the case.

- Potential Counterclaims and Need for A Jury Trial Right. The claim holder needs to consider potential counterclaims the debtor or its estate may assert in response to the proof of claim. Sometimes it is critical to one’s strategy to require a jury to decide the cases and not the bankruptcy judge. Also, some types of claims (such as preference claims), will be easier for a debtor to establish in front of a bankruptcy judge rather than a jury because of the complexity of these bankruptcy issues to lay jurors versus professional bankruptcy judges.

- Personal injury and wrongful death claims. The Bankruptcy Code preserves the right to jury trial for personal injury and wrongful death claims. This situation arises in mass tort cases, with numerous claimants holding personal injury tort claims against a debtor.

- Offsets/Recoupment Rights. If you are subject of a claim by the debtor or if you may be the target of a lawsuit by the debtor, you may want to file and hold a prepetition claim such that you can use your claim to offset or recoup against any one the debtor or its estate may have against you.

- Venue. It is important to know where the bankruptcy case is pending. The distance to the court may affect the claimholder’s ability to adequately prosecute and defend claims in the court. Experienced bankruptcy attorneys will be able to provide information on how particular claims may fare in front of the specific bankruptcy judge hearing the case.

These are some threshold factors to consider when deciding whether to file a proof of claim. While a proof of claim is a simple form to complete, the decision whether to file is not as simple.

The content of this blog post is for informational purposes only and does not constitute legal advice. It provides a summary, and the referenced materials should be reviewed for full details. The information may not reflect current legal developments. The date of the publication of the post is applied at the discretion of the editor and no reliance should be made on the date of publication. Please reach out to Parkins & Rubio LLP or your attorney for guidance.

Topics Discussed: Bankruptcy Rule 3001(b)(1), Counterclaims, Offsets-Recoupment Rights, Proof of Claim